When it comes to building a robust investment portfolio, diversification strategies play a crucial role in managing risk and optimizing returns. Whether you are a seasoned investor or just beginning your financial journey, understanding the principles of diversification can be the key to achieving long-term financial success.

Diversifying your investments means spreading your capital across various asset classes, industries, and geographic regions to reduce exposure to any single risk. In this blog post, we will explore two fundamental diversification techniques that investors in the USA can adopt. You will gain insights into the importance of these strategies and learn practical steps to implement them effectively for securing your financial future.

Comprehensive asset allocation

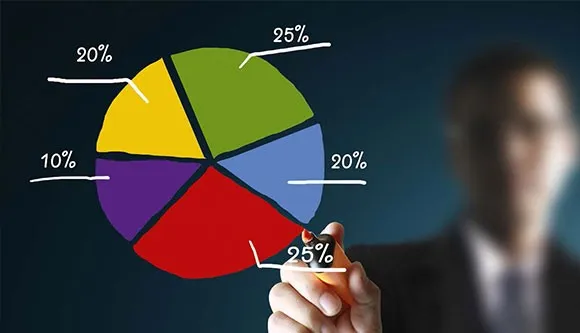

One of the most widely recognized methods for diversifying your investments is through comprehensive asset allocation. This approach involves distributing your investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities, each with its own risk and return profile.

The primary aim of comprehensive asset allocation is to reduce risk by ensuring that your portfolio is not overly dependent on the performance of any single asset class. Different asset classes typically react differently to market conditions; for example, while the stock market might experience significant volatility, bonds often provide a more stable return.

By strategically allocating your resources across various asset types, you can mitigate potential losses in one area with gains in another, thereby balancing your overall portfolio and enhancing the likelihood of achieving your long-term financial goals.

Equity diversification

Within the realm of stocks, equity diversification stands out as another powerful tool for managing risk and enhancing returns. This strategy involves investing in a variety of stocks across different sectors, industries, and geographic regions, ensuring that your portfolio is not overly exposed to the performance of any single area.

The principle behind equity diversification is straightforward: don’t put all your eggs in one basket. By spreading your investments across multiple sectors, such as technology, healthcare, finance, and consumer goods, you can reduce the risk that comes from a downturn in any one sector. For example, if the technology sector faces a challenging period, strong performance in healthcare or consumer goods can help balance out your portfolio.

Moreover, investing in international markets can provide additional layers of security and growth potential, offsetting domestic market fluctuations and allowing you to capitalize on global economic opportunities. This global approach not only broadens your investment horizons but also helps protect your portfolio from the volatility of any single market, further securing your financial future.

Fixed-income diversification

Fixed-income diversification is another essential tactic for building a resilient investment portfolio. This strategy involves diversifying within bond investments, including government bonds, corporate bonds, and municipal bonds, each offering distinct risk and return profiles.

Government bonds are typically considered low-risk investments, backed by the full faith and credit of the issuing government, making them a stable option for conservative investors. Corporate bonds, on the other hand, may offer higher returns but come with increased risk, depending on the financial health of the issuing company.

Municipal bonds can provide attractive tax advantages, especially for investors in higher tax brackets, as the interest earned is often exempt from federal and, in some cases, state and local taxes. By mixing different types of bonds in your portfolio, you can achieve a balanced approach that aligns with your risk tolerance and income requirements.

This diversification within fixed-income assets not only helps mitigate the risk of any single bond defaulting but also ensures that your portfolio can generate steady income across various economic conditions, further enhancing your overall investment strategy.

Geographic distribution of investments

Another effective method of diversifying your portfolio is through geographic distribution. This means spreading your investments across various countries and regions to take advantage of different economic cycles. Investing only in the USA can expose you to regional risks such as economic downturns, political instability, or natural disasters.

Expanding your investments internationally can offer more stability and growth opportunities. Geographic distribution allows investors to capitalize on growth in emerging markets while maintaining stability with investments in developed economies.

International dtocks

Including international stocks in your investment portfolio can provide excellent diversification benefits. These stocks allow you to participate in the growth of companies outside the USA. This diversification can help cushion against the volatility of domestic markets and provide opportunities fueled by other economic conditions worldwide.

Emerging markets, for example, often offer higher growth potential, although they come with higher risks. Including these in your portfolio can enhance your overall strategy by balancing risk and reward.

Foreign bonds

Foreign bonds are an often-overlooked but valuable component of a well-diversified portfolio. Investing in bonds issued by foreign governments or corporations can provide additional layers of safety and return potential.

These bonds allow you to benefit from interest rates and economic conditions that differ from those in the United States, offering another method to mitigate risk. While foreign bonds do come with their unique set of risks, such as currency fluctuations and political instability, they remain a critical component of a global diversification strategy.